However , the notes do not guarantee any return of principal at maturity. In addition, the Fund may invest in securities or financial instruments not included in the benchmark. On or about February 28, I The Fund permits short-term trading of its Shares, which may result in additional costs for the Fund. Reflects no deduction for fees, expenses or taxes.

| Uploader: | Mezitaxe |

| Date Added: | 15 October 2004 |

| File Size: | 68.75 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 61093 |

| Price: | Free* [*Free Regsitration Required] |

In the course of this business, we or our affiliates may acquire non-public information about the issuers of the Reference Stocks or the Reference Stocks, and we will not disclose any f1.8.60 information to you.

Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the notes easily.

We cannot give you assurance that the performance of each Reference Stock will result in the return of any of your snm-128e investment. Reflects no deduction for fees, expenses or taxes. Shareholders should actively monitor their investments.

March Networks Searchlight for Retail. Because other dealers are not likely to make a secondary market for the notes, the price at which you may be able to trade your notes is likely to depend on the price, if any, at which JPMSI is willing to buy the notes. Compounding affects all investments, but has a more significant impact on an inverse fund.

As a result, the cost of maintaining a short position may exceed the return on the position, which may cause the Fund to lose money.

Fees and Expenses of the Fund. As a result, your investment in the notes may not perform as well as an investment in a security with a return that includes a non-contingent buffer. Purchasers who are not initial purchasers of notes at the issue price should consult their tax advisers with respect to the tax consequences of an investment in the notes, including possible alternative characterizations, as well as the allocation of the purchase price of the notes between the Deposit and the Put Option.

In addition, you may receive shares of a Reference Stock at maturity that never experiences a decline from its Initial Share Price in excess of the Protection Amount during the Monitoring Period. Typically, the value of outstanding debt instruments falls when interest rates rise.

This sn,-128s provides some indication of the risks of investing in the Fund.

Do not show this again. Using this approach, ProFund Advisors determines the type, quantity and mix of investment positions that the Fund should hold to approximate the performance of its benchmark.

SNMS Download -

You could lose money by investing in the Fund. According to its publicly available filings with the SEC, General Motors is primarily engaged in automotive production and marketing, and financing and insurance operations. Howeverthe notes do not guarantee any return of principal at maturity. As a prospective purchaser of a note, you should smn-128s an independent investigation of the Reference Stock issuers that in your judgment is appropriate to make an informed decision with respect to an investment in the notes.

Snms V - free download suggestions

For this table of hypothetical payments at maturity, we have also assumed the following: In addition, the Fund may invest in securities or financial instruments not included in the benchmark. Assumptions used in the chart include: Under these circumstances, if on the Observation Date the Final Share Price of the remaining Reference Stock declines from its Initial Share Price, your return on the notes will be based on the Least Performing Reference Stock, which Reference Stock will be different than the Reference Stock that initially declined by more than its Protection Amount.

These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. However, if a Trigger Event has occurred, you could lose the entire principal amount of your notes. Being materially over- or under-exposed to its benchmark may prevent the Fund from achieving a high degree of correlation with its benchmark. For example, if a Trigger Event occurs with respect to a Reference Stock and that Reference Stock experiences a significant closing price increase on the Observation Date such that its Final Share Price exceeds its Initial Share Price, your return on the notes will probably not be based on the performance of that Reference Stock.

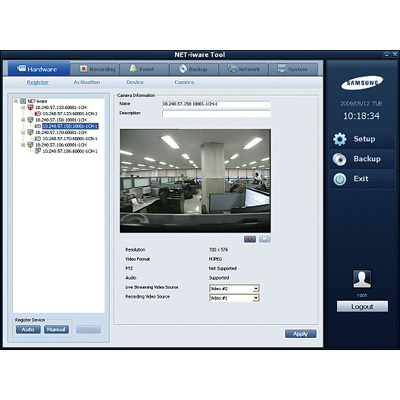

Hanwha Techwin America Techwin SNM-128S centralised video management software

Hanwha Techwin America Wisenet Mobile 1. In addition, the automotive and automotive financing industries are significantly affected by a number of factors that may either offset or magnify each other, including: You should make your own investigation into the Reference Stocks and their issuers. Key Terms Reference Stocks: If the snm-12s8 market price is greater when the time comes to buy back the security plus accrued interest, the Fund will incur a negative return loss on the transaction.

In order to achieve a high degree of correlation with its benchmark, the Fund seeks to rebalance its portfolio daily to keep exposure consistent with its investment objective.

Комментариев нет:

Отправить комментарий